The market’s record year may have more room to run, with sentiment buoyed by recent outperformance and historical trends.

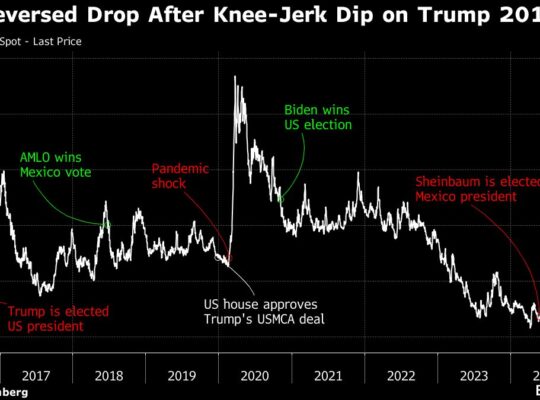

Stocks have notched all-time highs following President-elect Donald Trump’s victory earlier this month, as Wall Street remains optimistic over the incoming administration’s economic agenda despite looming tariff risks.

“Tariff threats may trigger near-term market volatility, but the fundamental backdrop remains supportive,” UBS Global Wealth Management’s Mark Haefele wrote in a note to clients on Wednesday.

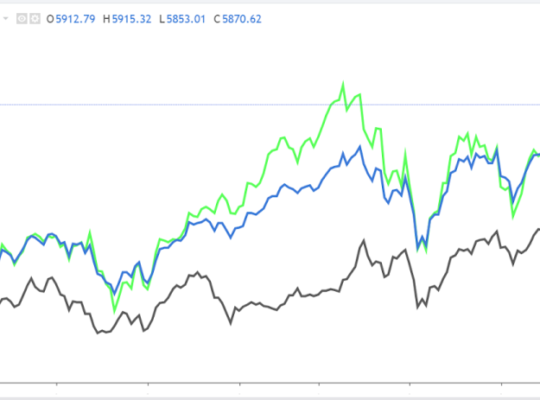

This year, the S&P 500 (^GSPC) has notched more than 50 all-time closing highs, while the Dow Jones Industrial Average (^DJI) and Nasdaq 100 (^NDX) are not far behind.

Looking ahead, strategists suggest the market’s bull year could end on a positive note.

“At this point, you can’t deny that everything looks positive,” Michele Schneider, chief strategist for MargetGuage.com told me on Yahoo Finance’s Morning Brief, adding that investors should “stay with the momentum and stay with the trend.”

Using history as a guide, the odds are for that trend to be on the upswing. According to CFRA’s Sam Stovall, December is the S&P 500’s most consistent month of gains, with the greatest frequency of advances (batting average). It also has the lowest volatility — nearly 40% below the average for the other months since World War II.

During the month, the S&P MidCap 400 and SmallCap 600 indexes have outperformed other areas of the market, followed closely by the Utilities (XLU), Industrials (XLI), Materials (XLB), and Financials (XLF) sectors.

What sets this year apart is the election adding to the bullish sentiment. December historically ranks as the S&P 500’s second-best month of the year during election years, with an average return of 1.3% since 1950, according to analysis from Carson Group’s Ryan Detrick.

His analysis also found that strong year-to-date performance often increases the chances that investors will chase the market into year-end. Of the past 10 times the S&P entered December up more than 20%, the month of December recorded an average gain of 2.4%.

Looking further ahead, the potential for a Santa Claus rally — which is when stocks climb higher in the final five trading days of the year plus the first two trading days of the New Year — could further boost returns.

Stock Trader’s Almanac editor in chief Jeff Hirsch, who explains that Thanksgiving kicks off a run of solid bullish seasonal patterns for the market, recently wrote that he has “combined these seasonal occurrences into a single trade: Buy the Tuesday before Thanksgiving and hold until the 2nd trading day of the New Year. Since 1950, S&P 500 has been up 79.73% of the time from the Tuesday before Thanksgiving to the 2nd trading day of the year with an average gain of 2.58%.”