Shares of Meta Platforms (NASDAQ: META) have crushed the broader market handsomely in the past year with impressive gains of 154%, driven by robust growth in its top and bottom lines. It looks like its eye-popping rally is here to stay following its latest earnings report.

Meta Platforms released its fourth-quarter and full-year 2023 results on Feb. 1. Shares of the company jumped 20% the following day thanks to its better-than-expected numbers and guidance. The good part is that Meta stock remains affordable, and investors who haven’t bought this tech giant yet should consider buying it hand over fist right now.

Meta Platforms is becoming a bigger player in the digital ad market

Meta Platforms reported Q4 revenue of $40.1 billion, an increase of 25% over the year-ago period. Additionally, the company reduced its costs and expenses by 8% during the quarter, which allowed it to triple its adjusted earnings on a year-over-year basis to $5.33 per share. The numbers were better than consensus expectations of $4.96 per share in earnings on revenue of $39.2 billion.

It is worth noting that Meta’s Q4 revenue grew at the fastest pace since the middle of 2021 and outpaced the company’s full-year revenue increase of 16%. The tech giant’s full-year earnings were up 73% to $14.87 per share on account of its focus on controlling costs and improving the efficiency of its business operations in 2023.

Meta benefited from an improvement in digital ad spending last year. According to eMarketer, digital ad spending increased 10.7% in 2023 to $627 billion. So, Meta grew at a faster pace than the market in which it operates. Moreover, its 2023 revenue indicates that it controlled 21.5% of the digital ad space last year. That’s an improvement over the 20.5% share in 2022.

Even better, Meta’s revenue forecast for the first quarter of 2024 indicates that it could continue to corner a bigger share of the digital ad market. The company is anticipating almost $36 billion in revenue in the current quarter at the midpoint of its guidance range. That would be a 25% increase over the prior-year period’s figure of $28.6 billion. Meanwhile, overall digital ad spending is estimated to jump 13.2% in 2024.

Artificial intelligence (AI) could be a key reason why Meta is gaining ground in the digital ad space. The company pointed out on its latest conference call with analysts that it continues to “leverage AI across our ads systems and product suite” in a bid to improve monetization efficiency. Meta’s offerings such as Advantage+, which allows advertisers to create automated ad campaigns with the help of AI and optimize those campaigns to drive greater returns on ad dollars spent, are gaining solid traction among its customers.

The company also released new generative AI features in the previous quarter for advertisers, with which they can generate multiple background images that complement product images and create alternative versions of advertising text so that they can choose the one that will help them improve reach. Meta management says that the “initial adoption of these features has been strong and tests are showing promising early performance gains.”

The adoption of AI in the digital marketing space is forecast to increase at an annual rate of almost 27% through 2030. AI in digital marketing is expected to generate annual revenue of $79 billion in 2030 compared to just $1.8 billion in 2022. So, Meta is pulling the right strings to ensure that it can keep winning a bigger share of the digital ad market by giving advertisers more AI-focused tools.

Stronger growth could lead to more upside

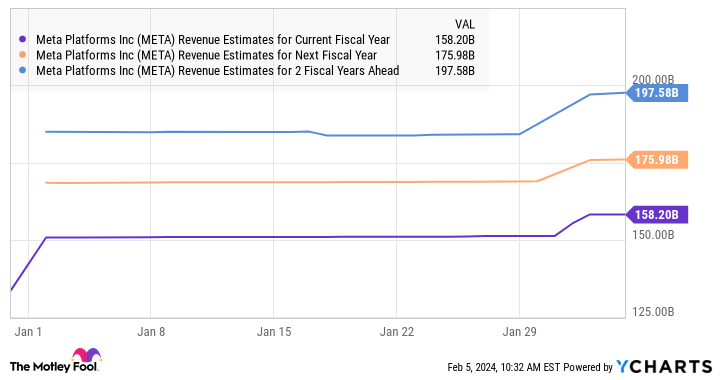

It is not surprising to see analysts expecting Meta’s growth to remain solid in the coming years.

As the chart above shows, Meta has received a nice bump in analyst revenue estimates for 2024, 2025, and 2026. What’s more, analysts are expecting Meta’s earnings to increase at a compound annual growth rate (CAGR) of 32% for the next five years. That would be a big jump over the 8.5% CAGR the company has clocked in the last five years.

Assuming Meta does clock 32% annual earnings growth over the next five years, its bottom line could increase to almost $60 per share in 2028. Multiplying that 2028 figure by the company’s five-year average forward earnings multiple of 22 points toward a stock price of $1,320. That suggests 180% gains from current levels.

Given that Meta is trading at 25 times forward earnings right now, investors seem to be getting a good deal on the stock.

Should you invest $1,000 in Meta Platforms right now?

Before you buy stock in Meta Platforms, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Meta Platforms wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 5, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Meta Platforms. The Motley Fool has a disclosure policy.

Up 154%, This Magnificent Artificial Intelligence (AI) Stock Is a Screaming Buy Before It Skyrockets was originally published by The Motley Fool

Source link